|

Broad Ripple Random Ripplings

The news from Broad Ripple

Brought to you by The Broad Ripple Gazette

(Delivering the news since 2004, every two weeks)

|

| Brought to you by: |

|

|

|

|

|

|

Converted from paper version of the Broad Ripple Gazette (v04n14)

Property tax hikes result in confusion and action from area residents - By Ashley Plummer

posted: Jul. 13, 2007

In the past few weeks, area homeowners have joined together in large numbers to show their displeasure for one thing that is currently affecting all of them-a major increase in property taxes.

Politicians on all levels and both sides of party lines have begun the finger pointing for who is to blame for the estimated 24 percent average hike in property taxes. However, no one can seem to explain the exact reasons for the increase in a clear manner for anyone-politicians and residents alike.

State Representative Cindy Noe (R-Indianapolis) attempts to speak over angry voices of taxpayers at a rally at the Governor's mansion on July 7, 2007.

"I have always been an advocate of fair taxes, but my taxes have a cumulative increase of 522 percent over the last two increases," Broad Ripple resident Richard Bee said. "However, this is a good crack on the head [for residents]. Complacency sets in and people begin to accept things the way they are. We voted for the people who make these decisions."

Since the mailing of property tax bills on July 1, 2007, which is the date when all laws passed by the 2007 Indiana General Assembly went into action, northside residents have staged two rallies in front of the Governor's Mansion, July 4 and July 7.

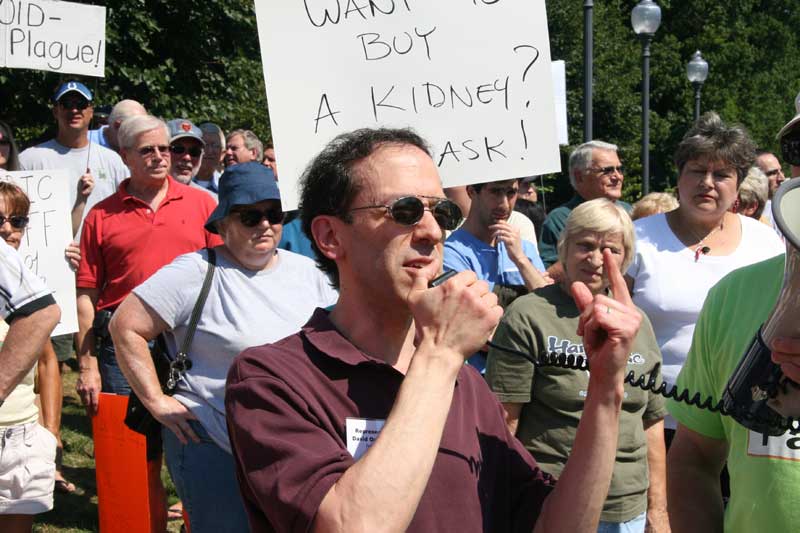

At a rally on July 7, 2007, State Representatives David Orentlicher (D-Indianapolis) and Cindy Noe (R-Indianapolis), who represent districts 86 and 87 (which cover large majorities of the Broad Ripple, Meridian-Kessler and Butler-Tarkington areas), attempted to explain their feelings on the property tax problem over loud shouts and jeers from rally-goers.

Protestors on July 7. The third sign from the right is promoting the sale of a taxpayer's kidney.

"The things we can do immediately are replace property taxes with income taxes and create a hardship fund for the people who need help immediately," Orentlicher said.

Representative Orentlicher was practically booed off the stage by attendees screaming "Politicians! Politicians! We don't need anymore politicians! Get him out!"

Representative Noe followed Orentlicher by placing blame on Democrats for the tax fiasco that residents have found themselves in.

"I am heartbroken of the folks calling me. I can tell you the only call for a special session is coming because we did not do what we need to do in the regular session," she said. "The opportunity to address property taxes long-term passed us up with last Fall's election that put us back under the leadership of Speaker Pat Bauer. . . We need to work together under new leadership."

Similar to Orentlicher, Noe's words were barely heard over angry residents screaming the same phrases that her Democratic counterpart received.

Rally organizers who spoke after the representatives pointed out that this was not about partisanship politics or bipartisan politics.

"This, right now, immediately, is not a political issue," one speaker said. "We need the help now. We don't care about the politics."

Beyond the political or non-political view of the issues, property taxes in Broad Ripple and the surrounding neighborhoods have generally risen beyond the estimated average of 24 percent to as much as 289 percent, according to Ken Goodman who lives at 4270 North Meridian.

"The 289 percent increase came after a 78 percent increase in 2003," Goodman said. "How can you justify this? These people are sick. We have a big house because we have ten children and I cannot get even two-thirds of what my house is worth (his house has been on the market since 2003).

"I think this is the tip of a very icy iceberg."

While residents are experiencing the first phase of the new property tax laws, many are seeking explanation for exactly why the hike came so quickly with such a major increase. The answer relates to decisions made in the 2005 and 2007 state budgets, which also hammer out how state tax dollars are assessed and spent.

Property taxes relate directly to the funding of local services, including public schools, police and fire departments.

In 2002 lawmakers created a budget increasing funding from the state for property tax replacement credits, which locked in rates. Additionally, in the 2005 budget a cap was placed on property taxes to keep them from rising along with a school funding formula that heavily relied on property taxes and a tax break program that focused largely on businesses.

This incentive toward big business in 2005 eliminated state inventory tax, which shifted the tax burden from big businesses to local homeowners.

Along with the business tax break, the 2005 budget also eliminated state contribution to public school funds by 4.7 percent, which forced the tax dollars from local home owners to fund their school corporations.

Beyond decisions that were made by state politicians in 2005, a decision by the Supreme Court in 2002 has also affected the price to own property.

The annual adjustment of assessed values in real property is called trending. The 2002 Supreme Court decision ruled that local tax assessors had to use current market values to determine property tax rates. Numerous areas in Indiana still had property tax rates that used 1999 assessments, but local assessors are now lawfully required to begin trending and base new property tax rates on 2005 and 2006 real estate values.

In other words, the low cost of living that many Hoosiers, specifically in a city like Indianapolis have enjoyed in the past decade or so has been a direct result of the lack of trending in the state.

While there is no way taxpayers will see immediate relief, the General Assembly has estimated that they will have $550 million in tax relief to mail to 13.4 million Indiana residents at the end of the 2007 fiscal year. This money comes as a direct result of other legislation enacted in the 2007 legislative session, which dedicates money from licenses to install and keep slot machines at Indiana's race tracks.

Many legislators are using this promise of a refund check to citizens as a way of depicting a "light at the end of the tunnel." However, what is expected to be a check around $250 seems dismal to many residents of the Broad Ripple area who have seen their property taxes double with the past increase, like Dennis Smith.

"That rebate will be a slap in the face," he said.

Other residents were discussing that the increase would have made more sense and been more affordable if it had come in stages of tax raises.

One thing that remains true is that there is currently no one person, one party or one level of government to blame for the increase. The state government may be currently controlling property tax adjustments, but in 2008 the power will eventually be given to local government bodies who will then have the power to handle their finances in a more appropriate manner for their area.

Many area neighborhoods are currently coming together to have open forums for discussion on how to take care of problems specific to property taxes. Jody French in the Forrest Hills neighborhood has organized a meeting on July 19, 2007, at 6 p.m. at the corner of Guilford Ave. and Wildwood Ave. to inform neighbors on how to access taxes, file appeals and how to deal with other various tax issues.

"This is not a rally or a party bashing event," French said. "This will just be a time and place to facilitate questions."

The Gazette will continue to attempt to explain the property tax situation to residents in upcoming issues. However, we would like to hear about your personal experiences with property taxes or your questions regarding the increases. Please email Ashley@broadripplegazette.com with questions, inquiries and personal accounts.

- - - - - - - - - - - - - - - - - - - - - - - - - -

Indiana Property Tax Timeline

- 1999-Last time most property taxes are assessed in Indiana.

- 2002-Budget increases funding from state for property tax rates, Supreme Court rules local tax accessors must use current market values to determine rates.

- 2005-Inventory tax is eliminated for Indiana businesses, cap placed on property taxes, school funding formula created that relies on property taxes.

- 2007-Trending takes place, property taxes adjust to current assessments.

|

|

|

| Brought to you by: |

|

|

|

| Brought to you by: |

|

|

|